nebraska car sales tax form

For Motor Vehicle and Trailer Sales. Free Nebraska Car Bill of Sale Form Word PDF Posted on September 15 2022 by exceltmp.

Our Pendleton Blankets Are Robe Size The Size Preferred By Native Americans For Ceremonial Pu Native American Blanket Pendleton Wool Blanket Pendleton Blanket

To sign over the Nebraska vehicle title you and the buyer.

. A Nebraska motor vehicle bill of sale is a legal document that provides information with regard to the seller buyer and vehicle to prove that a. A completed Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6. For July 2022 the city received a total of 5404791 from the Nebraska Dept.

20 hours agoTheres a new monthly record for Imperial city sales tax receipts and it was by a large margin. Nebraska vehicle title and registration resources. Driver and Vehicle Records.

In addition to taxes car. Vehicle Title Registration. For vehicles that are being rented or leased see see taxation of leases and rentals.

My Nebraska Sales Tax ID Number is 01-_____. File sales tax faster with Avalara Returns for Small Business. IRS Form W-9.

The statewide sales tax for Nebraska is 55 for any new or used car purchases. PURCHASERS NAME AND ADDRESS SELLERS NAME AND ADDRESS. Ad Download Or Email Form 6 More Fillable Forms Register and Subscribe Now.

Transferring Your NE Title. Risk Free for 60 Days. If none state the reason _____.

You will have to complete a Nebraska car bill of sale form while buying or selling. Ad Automate sales tax returns with our low cost solution built for mulit-channel sellers. Updated August 25 2022.

While some counties forgo additional costs most will charge a local tax on top of the state. That physically become part of. Car Sales Tax on Private.

IRS 2290 Form for Heavy Highway Vehicle Use Tax. Ad NE SalesUse Tax and Tire Fee Statement More Fillable Forms Register and Subscribe Now. Therefore your car sales tax will be based on the 40000 amount.

Sales and Use Tax Form 17 to the Form 13 and both documents must be. Nebraska SalesUse Tax and Tire Fee Statement. Registration Fees and Taxes.

Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. You will subtract the trade-in value by the purchase price and get 40000.

See Our Gallery Of Minnesota Commercial Paving Projects Twin Cities Paving Country Roads

Ebay Or Etsy Sale Of 600 Now Prompt An Irs Form 1099 K Money

Generate Business Leads Free Membership At Https Salesexpert Me Led Legalshield Generation

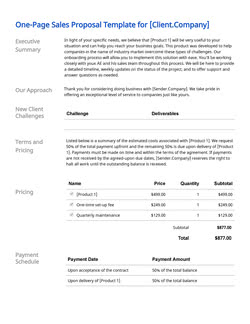

Fully Customisable Sales Proposal Templates Free Samples Pdfs

Free Sales Receipt Template Word Pdf Eforms

How To Write A Bill Of Sale Howstuffworks

Most People Are Supposed To Pay This Tax Almost Nobody Actually Pays It Planet Money Npr

Rogue Voodoo Doughnut Pretzel Raspberry Chocolate Ale Malt Beer Craft Brewing Craft Beer

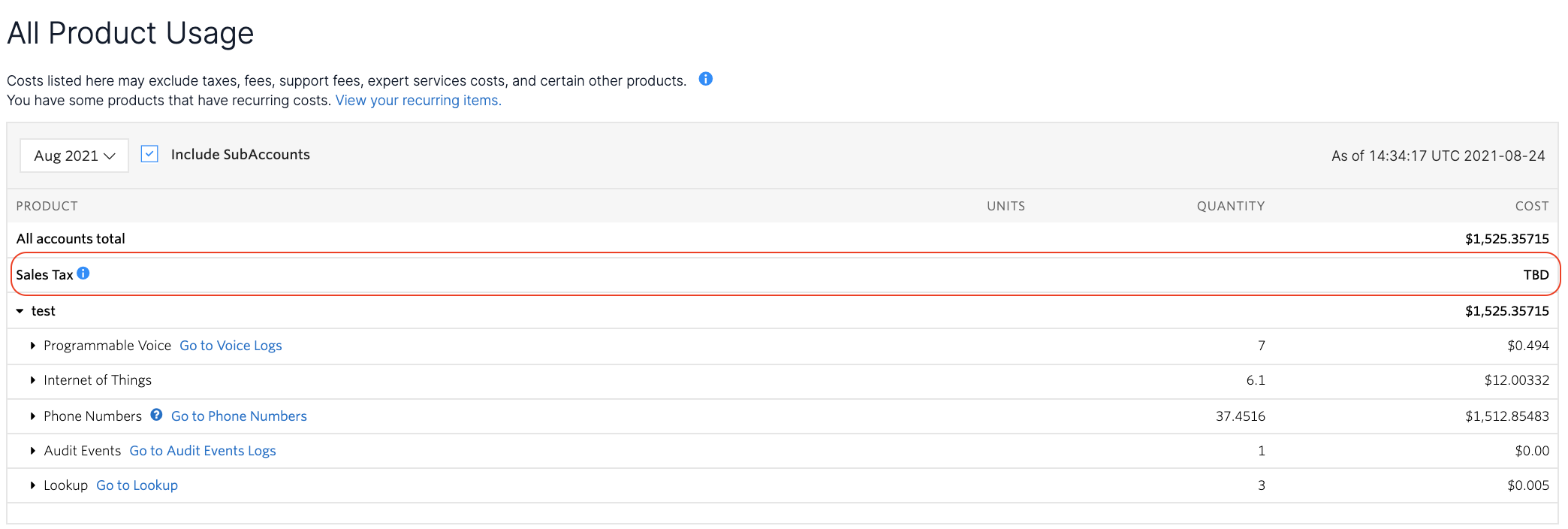

Does Twilio Charge Us Sales Or Telecommunication Taxes Twilio Support

Japan New Electric Vehicle Sales 2020 Statista

Fully Customisable Sales Proposal Templates Free Samples Pdfs

Elegant Sterling Silver Ring With Stunning Design Mint Etsy Sterling Silver Rings Silver Rings Sterling Silver

Car Financing Are Taxes And Fees Included Autotrader

Free Receipt Templates Samples Word Pdf Eforms

Nebraska Sales Use Tax Guide Avalara

2006 Harley Davidson Vrscr Harley Davidson Harley Davidson Road Glide Harley Davidson Bikes